How to Calculate Return on Investment

Calculating your return on investment is actually pretty straightforward. You just take the final value of your investment, subtract what you paid for it, and then divide that number by the original cost. To get the percentage everyone talks about, just multiply that result by 100. This simple formula cuts through the noise and tells you how profitable something really was.

What Return on Investment Really Means

Before we get bogged down in the math, let's talk about what ROI actually is. At its heart, ROI is a powerful way to measure how much bang you got for your buck. It answers the most fundamental question in business: "For every dollar I put in, how much did I get back?"

This isn't just a number to report in a meeting; it’s a crucial tool for making smart decisions. It helps you compare totally different opportunities on an even playing field. Should you fund that new marketing campaign or upgrade your team's software? Which of two potential projects is the better bet? ROI gives you the clarity to decide.

Historically, investors have relied on this metric to compare investments. Think about it: if you bought $1,000 worth of stock and it grew to $1,200, your net profit is $200. That gives you a 20% ROI. This simple approach creates a standard way to evaluate performance, a concept that has been central to financial markets for decades, as seen in historical data from sources like NYU Stern.

Breaking Down the Core Components

To really get ROI right, you have to look past the basic formula. The two main inputs, Net Profit and Cost of Investment, need a bit of digging to make sure your calculation is accurate and, more importantly, useful.

To help clarify these inputs, here's a quick breakdown of what goes into the formula.

Key Components of the ROI Formula

| Component | Definition | Example |

|---|---|---|

| Net Profit | The total financial gain from the investment, minus all associated costs. It’s what you actually made. | If a marketing campaign generated $50,000 in new sales and cost $10,000 to run, the Net Profit is $40,000. |

| Cost of Investment | The total amount of money and resources spent to acquire and implement the investment. This includes both direct and indirect expenses. | For new software, this isn't just the license fee. It also includes the cost of employee training hours and any necessary hardware upgrades. |

| Final Value | The total value or revenue generated by the investment at the end of a specific period. | The total sales revenue from an advertising campaign or the increased value of a stock holding. |

Getting these components right is the key to an ROI figure you can actually trust.

What trips a lot of people up are the "soft" or indirect costs that get left out of the equation. These are the things that don't show up on a single invoice but are absolutely part of the true cost.

We're talking about things like:

- Employee Time: The hours your team spends in training, on implementation, or just managing the new project.

- Software and Subscriptions: All those monthly or annual fees for tools needed to support the investment.

- Operational Overhead: Any extra resources or administrative support that the investment requires.

If you don't account for these hidden expenses, you'll end up with a wildly optimistic ROI that could lead you to make the wrong call next time. An accurate calculation tells the full story.

Key Takeaway: A true ROI calculation must include all direct and indirect costs associated with an investment. The more comprehensive your cost analysis, the more reliable your final ROI figure will be for guiding future business strategy.

Getting a handle on this metric is a huge first step in tracking your company's financial health. When you calculate ROI properly, you get a clear signal of efficiency, which is a key part of how you can effectively measure business growth. Think of it as a foundational piece of your financial toolkit, one that empowers smarter, data-driven decisions that push your business forward.

Putting the ROI Formula into Practice

Knowing the formula is one thing, but actually applying it to a real-world business scenario? That's a completely different ball game. Let's move past the theory and walk through how you can calculate the return on investment for any project and be confident you’re getting the full picture. This process is less about plugging numbers into a calculator and more about strategic thinking.

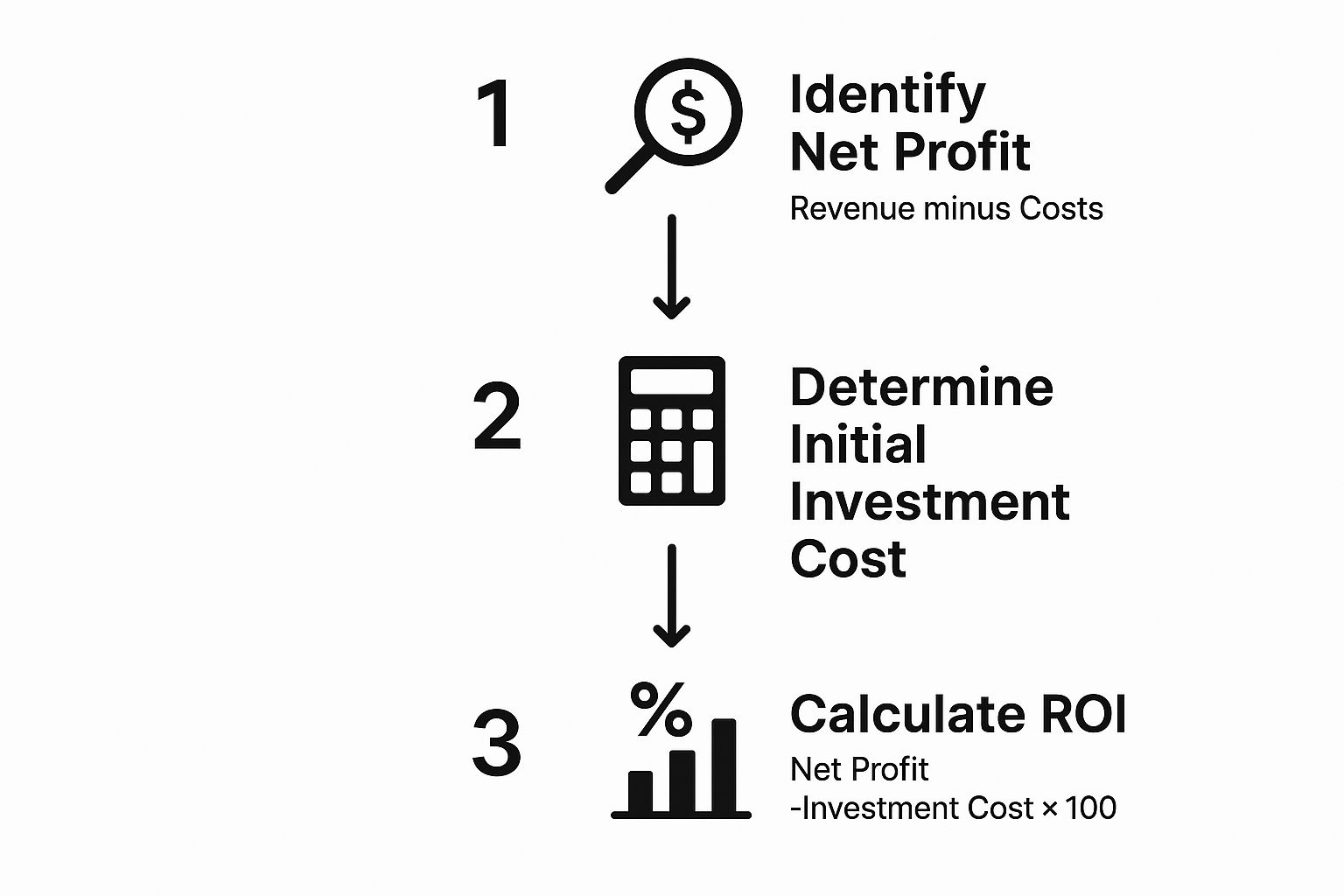

This graphic breaks down the core steps, giving you a visual flow from identifying your profit all the way to the final ROI percentage.

As you can see, it really boils down to two key ingredients: your net profit and your total investment cost. Get those right, and you'll get a clear, reliable ROI.

Accurately Identifying Your Total Investment Cost

First things first, you need to get an honest, all-in total for your investment cost. This is where so many ROI calculations fall apart. It's easy to remember the big invoice for a new piece of software, but the hidden "soft costs" are what will really skew your results if you ignore them.

You have to think beyond the initial price tag. Your total investment is a sum of many parts:

- Direct Costs: This is the obvious stuff—the software subscription, the new hardware, the ad campaign budget.

- Implementation and Setup Fees: Did you pay a consultant for integration? Were there one-time setup charges? These are direct investment costs and belong in your calculation.

- Employee Training Time: Don't forget to calculate the cost of your team's time spent learning the new tool. Just multiply their hourly wage by the hours they spent in training. A team of five spending eight hours each learning a new system, at an average wage of $40/hour, adds a quick $1,600 to your investment.

- Ongoing Maintenance and Support: Make sure to include any recurring fees for support plans or necessary software updates that keep the investment functional.

Adding up all these direct and indirect expenses gives you the true denominator for your ROI formula. It's the only way to avoid an inflated, misleading result.

The most common mistake I see is people only counting the sticker price. True ROI clarity comes when you account for every associated cost, especially the person-hours your team pours into getting a new tool off the ground.

Determining the Financial Return

Once your costs are tallied up, it's time to measure the return. Sometimes this is straightforward, like tracking direct revenue from a sales campaign. But more often than not, you'll need to figure out how to put a dollar value on less tangible benefits.

Let's imagine your company just invested in a new CRM. The return isn't just about the new deals you closed. You also have to quantify the "soft" returns:

- Increased Sales Revenue: This is the most direct return. You can track the lift in sales that's clearly attributable to the new CRM's features, like improved lead tracking or follow-up automation.

- Improved Team Efficiency: What if the CRM saves each of your 10 sales reps 5 hours a week? That's 50 hours of productive time you've gotten back. At an average loaded cost of $50/hour per rep, that’s a $2,500 weekly return just in efficiency gains.

- Reduced Operational Costs: Did the new, all-in-one CRM allow you to finally cancel subscriptions for three other redundant tools? If that saves you $300 per month, that's a direct financial return you can add to the pile.

By converting benefits like time savings into a hard dollar amount, you capture the full value your investment is delivering. This gives you a much sharper, more accurate understanding of how it's actually performing.

Putting ROI to the Test: Real-World Scenarios

The ROI formula is great on paper, but it really comes to life when you apply it to actual business decisions. Moving from theory to practice is where you see how powerful this simple metric can be for justifying expenses and steering your strategy.

Let’s walk through a few common situations to see how this plays out.

Investing in a B2B SaaS Project Management Tool

Picture this: your agency is sinking money into a new project management platform. The whole point is to cut down on wasted hours and sidestep those expensive mistakes that come from missed deadlines.

First, you need to tally up the full investment for one year.

- Annual Subscription: $6,000 for your 10-person team.

- Implementation & Training: You'll spend 20 hours getting everyone up to speed. At a loaded cost of $50/hour, that's another $1,000.

- Total Investment Cost: That brings your total outlay to $7,000.

Now for the good part—quantifying the return. The new software saves each of your 10 employees about two hours a week.

- Weekly Time Savings: 20 hours x $50/hour equals $1,000 back in your pocket every week.

- Annual Time Savings: Over 50 work weeks, that adds up to a hefty $50,000.

- Error Reduction: On top of that, the tool helps you dodge two major project blow-ups a year. Historically, those have cost you $5,000 each, so you're saving another $10,000.

- Total Annual Return: Your total gain is $60,000.

With these numbers, the ROI calculation becomes crystal clear.

- Net Profit: $60,000 (Return) – $7,000 (Cost) = $53,000

- ROI: ($53,000 / $7,000) x 100 = 757%

An ROI like that speaks for itself. It moves the conversation from a vague "I think this makes us more efficient" to a concrete, data-backed statement: "This tool generates a 7.5x return on our investment."

Launching a Digital Marketing Campaign on LinkedIn

Let's switch gears to a B2B company running a LinkedIn Ads campaign. Their goal is to capture leads for a high-ticket consulting service. Here, tracking the https://makeautomation.co/roi-of-marketing-automation/ and ad spend is absolutely essential for knowing where to put your budget next quarter.

- Total Investment: The company puts $10,000 into ad creative and clicks over a three-month period.

- Total Return: The campaign pulls in five new clients. With a Customer Lifetime Value (CLV) of $15,000 each, the total return is a solid $75,000 (5 x $15,000).

The ROI calculation is straightforward:

- Net Profit: $75,000 (Return) – $10,000 (Cost) = $65,000

- ROI: ($65,000 / $10,000) x 100 = 650%

This result proves the campaign was a massive success and makes it easy to argue for increasing the ad budget.

Upgrading Office Hardware (A Capital Expenditure)

Finally, let's look at a classic capital expenditure: replacing the team's ancient laptops. This kind of investment is all about boosting productivity and slashing the time and money spent on IT maintenance. When you're calculating ROI here, it's smart to look for strategies for immediate ROI by zeroing in on those quick productivity wins.

- Total Investment: The company buys 15 new laptops at $2,000 a pop, for a total cost of $30,000.

The return is generated from two key areas:

- Productivity Gains: The zippy new machines save each employee 30 minutes a day. With 15 employees at a $50/hour loaded cost, that’s a daily saving of $375. Over a 250-day work year, that becomes $93,750.

- Reduced Maintenance: You can say goodbye to the $5,000 in annual IT support and repair costs for the old hardware.

- Total Annual Return: Adding it all up, you get $93,750 + $5,000 = $98,750.

So, what's the first-year ROI?

- Net Profit: $98,750 (Return) – $30,000 (Cost) = $68,750

- ROI: ($68,750 / $30,000) x 100 = 229%

Even with a significant upfront cost, the investment pays for itself more than twice over in the first year alone. That's a powerful argument to present to any decision-maker.

Common Mistakes to Avoid When Calculating ROI

On the surface, calculating ROI seems pretty straightforward. But I've seen a few common missteps completely derail the process, turning what should be a powerful metric into a source of bad information.

If your ROI numbers are off, you might end up doubling down on a failing project or, even worse, pulling the plug on a winner. Getting it right means knowing what traps to sidestep.

Forgetting the "Soft" Costs

One of the most frequent errors I see is forgetting to account for all the indirect costs. Sure, you remembered the big invoice for that new software subscription, but what about the 40 hours your team spent in training to learn it? That’s a very real cost.

This initial dip in productivity during the ramp-up phase is a crucial part of your total investment. If you leave it out, your ROI will look artificially high.

Misattributing Your Returns

Here’s another big one: giving credit where it isn't due.

Let's say you launch a new ad campaign in the same month your sales team rolls out a more aggressive outreach strategy. Suddenly, sales jump by 20%. How much of that boost was really from the ads? It's easy to credit the new, shiny thing, but reality is often more complex.

To get a true picture, you have to isolate the impact of your investment. This is where careful tracking becomes non-negotiable.

- Set Up Control Groups: Test your new initiative on one segment of your audience while leaving another untouched. The difference between them is your real impact.

- Use Unique Tracking: Things like specific discount codes, dedicated landing pages, or campaign-specific UTM parameters are your best friends here. They tell you exactly where your results are coming from.

If you don't assign credit properly, you'll never know if the investment was actually responsible for the gains. And that makes it impossible to make smart decisions on future projects.

Ignoring Time and Risk

Perhaps the most subtle but dangerous mistake is forgetting that the basic ROI formula doesn't tell the whole story. It has two massive blind spots: time and risk.

Think about it. A project promising a 200% ROI that takes five years to pay off might be a much worse deal than one with a 75% ROI that delivers in just six months.

Time is a critical, often-overlooked variable in investment analysis. A high ROI over a long period can be misleading if it ties up capital that could have been used for quicker, albeit smaller, wins elsewhere.

Risk is the other piece of the puzzle. ROI doesn't account for market volatility or the chance of failure. An investment's potential return is always tied to a certain level of risk. For instance, a look at historical data shows just how much markets can swing; the S&P 500 delivered a 31.5% return in 2019 but then dropped by -18.1% in 2022.

You can dig into more data on average stock market returns on carry.com to see this variability for yourself. This is why a simple ROI percentage should always be considered alongside the investment's timeline and inherent risks. It’s the only way to make a truly informed decision.

Comparing ROI with Other Financial Metrics

While ROI is a fantastic starting point, it's not the only tool in the shed. Sometimes, you need a different lens to see the full financial picture. Other metrics can fill in the gaps that ROI leaves open, especially when it comes to cash flow and long-term value.

Here's a quick look at how ROI stacks up against a few other key metrics and when you might want to use them instead.

| Metric | What It Measures | When to Use It |

|---|---|---|

| Payback Period | The time it takes for an investment to generate enough cash flow to cover its initial cost. | When speed of return is your top priority. It's great for assessing liquidity risk. |

| Net Present Value (NPV) | The difference between the present value of cash inflows and the present value of cash outflows over a period of time. | For long-term projects where the timing of returns is crucial. It accounts for the time value of money. |

| Internal Rate of Return (IRR) | The discount rate that makes the NPV of all cash flows from a particular project equal to zero. | When comparing multiple projects with different timelines and cash flow patterns. |

| Customer Lifetime Value (CLV) | The total revenue a business can reasonably expect from a single customer account throughout the business relationship. | Essential for SaaS and subscription models. It helps you decide how much you can spend to acquire a customer. |

Ultimately, the best approach is to use ROI in concert with these other metrics. Each tells a different part of the story, and together they give you the comprehensive insight needed to make confident, strategic financial decisions.

Beyond the Basics: Advanced ROI Analysis

Once you get the hang of the standard formula, you quickly learn that a single ROI percentage doesn’t always give you the full picture. This is especially true when you're making major strategic decisions. Getting real financial insight means digging deeper and asking tougher questions about your investments.

A great place to start is with opportunity cost. For every dollar you put into Project A, that's a dollar you can't put into Project B. Smart leaders are always asking, "What's the next best thing I could do with this money?" An investment might look good with a positive ROI, but if a less risky alternative could bring in a similar or even better return, suddenly the decision isn't so simple.

Comparing Investments with Annualized ROI

This brings us to another critical tool: annualized ROI. Let’s say you have two options. One project delivers a 20% return in just six months, while another offers a 30% return but takes three years. It's an apples-to-oranges comparison, right? The basic ROI formula doesn't factor in time, but this is where annualized ROI levels the playing field.

By recalculating the return as if it were earned over a single year, you get a standardized metric. This lets you fairly compare investments with completely different timelines. You might just find that the shorter-term project with the lower overall ROI is actually the more profitable choice on an annual basis.

Key Insight: Annualized ROI is essential for comparing long-term and short-term investments accurately. It stops you from getting swayed by a high ROI that takes years to realize, helping you free up capital for faster-moving opportunities.

Forecasting ROI for Future Projects

Calculating ROI on a project that’s already finished is one thing. Trying to forecast it for something that hasn’t even started? That’s a whole different ballgame. It requires building a simple financial model based on solid, data-driven assumptions.

You’ll need to estimate all potential costs—including often-overlooked expenses like the SaaS customer acquisition cost—and project the expected returns from market data or the performance of similar projects. For a deeper dive into capital efficiency that goes beyond simple ROI, it's worth exploring metrics like how to calculate Return on Invested Capital (ROIC).

This kind of forecasting is particularly vital when you're looking at complex, long-term capital investments. Professional investors often analyze historical return data and market performance cycles. For instance, US equity markets have historically seen cycles of outperformance lasting over eight years compared to international markets. As detailed in research on market performance cycles on hartfordfunds.com, understanding these wider trends is crucial for anyone calculating ROI within a bigger economic picture.

By bringing opportunity cost, annualized returns, and data-backed forecasts into your process, you transform a simple calculation into a powerful strategic tool. This more nuanced view helps you make sure you’re not just picking a good investment—you’re picking the best one for your business right now.

Common Questions About Calculating ROI

Once you get the hang of the basic ROI formula, some practical questions almost always come up. Let’s walk through a few of the most common ones I hear. Getting these right is key to applying the ROI concept correctly in the real world.

Can ROI Be Negative and What Does It Mean?

Yes, absolutely. A negative ROI isn't a sign of a broken calculator; it just means the investment lost money. Simply put, the costs were higher than the returns.

Think of it as a clear signal that a particular initiative didn't pay off. For instance, if you poured $10,000 into a marketing campaign that only brought in $7,000 of new business, your ROI would be -30%. This isn't necessarily a failure, but rather valuable feedback. It tells you to either overhaul the strategy or cut your losses and put that budget somewhere more productive.

How Do I Calculate ROI for Something with Ongoing Costs?

This is a great question, especially with the rise of subscription-based services. For any investment with recurring costs, like a monthly SaaS subscription, you have to define a specific time period for your analysis.

Here's the practical way to approach it:

- Set a timeframe. Decide if you want to measure ROI on a monthly, quarterly, or annual basis. Consistency is key.

- Sum the costs. Add up all the subscription fees, implementation costs, and any other related expenses within that defined period.

- Total the returns. Tally up all the value generated—whether that's revenue, cost savings, or efficiency gains—during that same timeframe.

This method turns an ongoing expense into a measurable performance indicator, letting you see if the investment is still worth it over time.

For SaaS tools, I almost always recommend calculating the annual ROI. This approach smooths out any lumpy monthly results and gives you a much more stable, big-picture view of the tool's long-term value.

What Is a Good ROI for a Business?

I get asked this all the time, and the honest answer is, "it depends." There's no magic number that works for everyone. A "good" ROI is completely contextual. A 10% ROI might be incredible for a stable, low-risk real estate investment, but it would be a huge disappointment for a high-risk venture capital bet.

As a general rule, a good ROI should always be higher than your cost of capital (what it costs you to get the funds for the investment in the first place). Beyond that, benchmark your results against your industry's averages and, most importantly, against your own historical performance. Are you improving? That’s what matters.

How Do You Account for Non-Financial Returns?

This is where calculating ROI becomes more of an art than a science. What about "soft" benefits like a stronger brand reputation or happier employees? These are incredibly valuable, but they don't show up neatly on a balance sheet. The key is to find a way to assign a credible monetary value to them.

For example, to measure a jump in brand awareness, you could track the increase in organic website traffic and then calculate what that traffic would have cost if you'd paid for it through ads. For a boost in employee morale, you might link it to a measurable drop in turnover, then calculate the savings from not having to constantly recruit and train new people. It’s not perfect, but it’s the only way to get these critical, intangible benefits into your ROI equation.

Struggling to quantify the ROI of your manual processes? MakeAutomation specializes in building automated systems that deliver measurable returns by cutting costs and boosting efficiency. Discover how our tailored frameworks can optimize your workflows and drive real growth.