What Is Prospect Research Your Guide to Smarter B2B Sales

Think of prospect research as the detective work that happens before your sales team ever makes a call. It’s the process of digging into potential customers to figure out if they're a good fit, what makes them tick, and how likely they are to buy.

Essentially, it's how you turn a massive, overwhelming list of names into a short, curated list of genuine opportunities.

Beyond Guesswork: What Is Prospect Research?

Forget about blindly dialing for dollars. Modern prospect research is a methodical craft, a way of understanding who your ideal customers are, what they actually need, and when the time is right to reach out.

For B2B and SaaS teams, this is the secret to stop chasing dead-end leads and sending emails that disappear into a black hole. It’s a fundamental shift from a numbers game to a value game. The result? Fewer, more meaningful conversations that lead to bigger, better deals. You stop cold calling and start having informed discussions built on real insight.

The Shift From Information To Intelligence

At its heart, prospect research answers the critical questions that underpin any smart sales strategy. It’s about taking raw data—a name, a company, a job title—and turning it into actionable intelligence.

This means you’re not just looking at a contact; you’re uncovering their story. Understanding how to generate B2B leads that convert is all about this deeper level of research, which is what builds a profitable sales pipeline that lasts.

Your goal is to get the full picture of a potential customer, including things like:

- Company Health: Are they growing? Are they hiring for key roles? Did they just land a new round of funding?

- Business Challenges: What specific problems are they wrestling with right now?

- Buying Signals: Have they been checking out your website, downloading content, or engaging with a competitor online?

- Key Decision-Makers: Who really holds the purse strings and has the authority to say "yes"?

This kind of detailed understanding is the foundation of any successful sale. It shapes everything that follows, from your first email to your final pitch, making sure every single interaction hits the mark. It's the critical groundwork for a solid lead nurturing strategy, which you can read more about in our guide on what is lead nurturing.

Prospect research is the difference between showing up to a meeting with a generic sales pitch and showing up with a solution to your prospect’s most pressing problem—before they even have to explain it.

Ultimately, this data-driven approach lets your team stop wasting time on leads that were never going to close and focus their energy where it counts.

To bring this all together, modern prospect research really stands on four key pillars. Each one builds on the last to create a powerful, efficient sales motion.

The Core Pillars of Modern Prospect Research

This table breaks down the essential components that turn basic research into a strategic advantage for your sales team.

| Pillar | Objective | Key Outcome |

|---|---|---|

| Identification | Discover companies and individuals that fit your Ideal Customer Profile (ICP). | A high-quality, targeted list of potential customers. |

| Qualification | Analyze data to confirm a prospect's need, budget, and authority. | A prioritized pipeline of sales-ready leads. |

| Personalization | Uncover specific pain points, goals, and triggers for personalized outreach. | Higher engagement rates and more booked meetings. |

| Strategy | Inform the sales approach with deep insights into the prospect's world. | Shorter sales cycles and increased average contract value. |

When these four pillars work in sync, you’re not just selling—you’re solving problems for the right people at the right time.

The Three Layers of Prospect Data You Must Master

Great prospect research isn't just about digging up a name and an email address. It’s about assembling a complete, three-dimensional picture of a potential customer. Think of it like a detective building a case—you start with the basic facts and layer on more nuanced details until you have a clear understanding of motive and opportunity.

To get beyond surface-level info and uncover real, actionable intelligence, you have to work with three distinct layers of data. Each one answers a different, critical question. When you put them all together, you get a powerful, crystal-clear view of your best prospects.

Let's break them down.

Layer 1: Firmographics

Firmographics are the foundational facts about a company. This is the "who" and "what"—the basic, high-level details you need to know before anything else. Think of it as the company's vital statistics.

This is your first filter. Without it, you're just guessing, wasting precious time on companies that were never a good fit to begin with. The data here is usually stable and easy to find, giving you the essential context to see if a company even belongs on your radar.

Key firmographic data points include:

- Industry and Vertical: What business are they really in?

- Company Size: How many people do they employ? This is often a proxy for complexity and budget.

- Annual Revenue: What's their financial footprint? This helps you gauge their buying power.

- Geographic Location: Where are their headquarters and other key offices?

- Recent Funding: Have they just landed a big investment? That often signals they're ready to spend on growth.

Layer 2: Technographics

If firmographics tell you about the company, technographics tell you about its toolkit. This layer pulls back the curtain on the technology stack a business uses every single day, from their CRM and marketing automation to their web analytics software.

Understanding a company's tech stack is like getting a peek inside their workshop. You can see what tools they've already invested in, what they value, and—most importantly—where you fit in. For any SaaS company, this information is absolute gold.

Let's say you sell a productivity tool that integrates perfectly with Asana and Microsoft Teams. Discovering a prospect uses both is a huge buying signal. It gives you the perfect opening to start a conversation about improving the workflows they already rely on.

Technographic data transforms your pitch from, "Here's our cool product," to "Here's how our product makes the tools you already pay for even better."

Layer 3: Intent Data

This is where things get really interesting. Intent data is the most dynamic and powerful layer, made up of all the digital breadcrumbs a company and its employees leave behind as they browse the web. This data answers the most important question of all: "When is the right time to reach out?"

This behavioral layer is what tells you a prospect has gone from being a good theoretical fit to an active buyer in the market right now. While this is a cornerstone of B2B sales, the concept of using behavior to understand an audience is universal. For instance, even nonprofits are increasingly using behavioral insights for more precise segmentation, as noted by experts at Nonprofit Pro.

Common intent signals to watch for:

- High-Value Content Downloads: Someone from a target account just downloaded your latest industry report.

- Webinar Attendance: Key decision-makers from a prospect company registered for a webinar on a topic you solve.

- Third-Party Website Visits: Multiple employees from the same company are suddenly all over review sites like G2, comparing solutions like yours.

When you combine these three layers, you create a powerful system for finding and prioritizing your best opportunities. Firmographics and technographics help you build a qualified list, while intent data tells you exactly who on that list to call today. This multi-layered approach is fundamental to effective lead scoring best practices, making sure your sales team always focuses its energy where it counts the most.

Building Your Prospect Research Framework

Knowing what data to look for is one thing. Turning that knowledge into a predictable stream of high-quality leads is another entirely. Without a repeatable system, prospect research quickly devolves into a chaotic, time-sucking chore that delivers inconsistent results.

A solid framework is what separates random acts of research from a predictable growth engine. It ensures every rep on your team is following the same proven process, which lets you scale your efforts, measure what's actually working, and get better over time. Let's build that system, piece by piece.

Stage 1: Define Your Ideal Customer Profile

Before you can find the right prospects, you have to know exactly who you're looking for. Your Ideal Customer Profile (ICP) is your North Star here. Think of it as a living document that describes the perfect company for your product—and it goes way beyond just industry and company size.

A truly powerful ICP is built on cold, hard data, not gut feelings. Take a close look at your best customers right now. I'm talking about the ones who get the most value, are the most profitable, and stick around the longest. What do they all have in common?

Your ICP should nail down the specifics:

- Firmographics: What's their industry, employee count, and annual revenue? Where are their headquarters?

- Technographics: What key software is already in their tech stack? (Think CRM, marketing automation, project management tools.)

- Behavioral Traits: How do they operate? Are they early adopters always chasing the next new thing, or are they more conservative? Do they put a premium on innovation and speed?

- Pain Points: What specific, expensive problems does your solution actually solve for a company like this?

A well-defined ICP is the ultimate filter. It gives your team the confidence to say "no" to 99% of the market so they can pour all their energy into the 1% that truly matters.

Stage 2: Gather and Enrich Data

With your ICP as your guide, it's time to build a target list of accounts and gather the intel you need to reach out. This is where so many teams get bogged down, manually scraping websites and LinkedIn profiles for hours on end. The trick is to use a smart mix of tools and automation to work efficiently.

Start by pulling a list of companies that fit your ICP using databases like LinkedIn Sales Navigator, ZoomInfo, or Apollo.io. But once you have that initial list, the real work of enrichment begins.

Enrichment is all about adding layers of context to that raw list. This means:

- Identifying Key People: Find the actual decision-makers and influencers inside your target accounts. Look for job titles that line up with the problem you solve (e.g., Head of Sales, VP of Operations).

- Finding Contact Information: Use dedicated tools to track down verified email addresses and direct phone numbers for your key contacts.

- Uncovering Buying Signals: Hunt for recent news, press releases, hiring sprees, or social media chatter that signals a real need for what you sell.

Stage 3: Qualify and Score Leads

Just because a prospect fits your ICP doesn't mean they're ready to buy today. This stage is all about prioritizing your outreach so your reps spend their valuable time on the opportunities most likely to close.

Lead qualification is simply about confirming a prospect meets your minimum criteria. A classic framework like BANT (Budget, Authority, Need, Timeline) is a great place to start. Does the company have the budget? Is your contact the one who can sign the check? Do they have a clear need? And is there a pressing timeline?

Lead scoring takes this a step further by assigning points to prospects based on who they are and what they do. This creates a clear hierarchy, sorting your leads from "red hot" to "ice cold."

For instance, your scoring system might look something like this:

- +10 points: Company is a perfect match for your ICP.

- +15 points: Key decision-maker just downloaded your latest case study.

- +5 points: They visited your pricing page in the last 7 days.

- -5 points: They're based in a region you don't serve.

A system like this gives your reps a clear, data-driven priority list to tackle every single morning.

Stage 4: Personalize Your Outreach

This final stage is where all your hard work pays off. Armed with rich data and a prioritized list, you can finally ditch the generic, templated emails and start writing messages that actually connect with your prospects.

And let's be clear: effective personalization is not just dropping {{first_name}} into a template. It’s about proving you’ve done your homework and understand their specific world.

Your research should give you everything you need to open a conversation with a highly relevant hook, like:

- "I saw your company recently brought on a new VP of Marketing…"

- "Congrats on the new funding round! I imagine scaling the sales team is a top priority."

- "I noticed you're using Salesforce and Marketo. Our platform integrates with both to help solve…"

This level of detail shows you're not just another salesperson blasting out emails—you're a potential partner who's taken the time to understand their business. Platforms like Make can even help automate parts of this by connecting your tools through pre-built templates.

This screenshot shows just a few of the integration recipes available on Make, giving you an idea of how you can connect different apps to build automated workflows.

These templates are the building blocks for automating the data gathering and enrichment stages of your prospect research. By following this systematic, four-stage framework, you can turn prospecting from a frustrating guessing game into a science, creating a reliable and scalable pipeline of fantastic leads.

The Modern Prospect Research Toolkit

Trying to do prospect research manually these days is like digging for gold with a teaspoon. You might find something eventually, but you’ll be exhausted, and the competition with their heavy machinery will have cleaned out the mine long before you get there. Modern sales teams don't work that way; they run on a smart toolkit built for speed and precision.

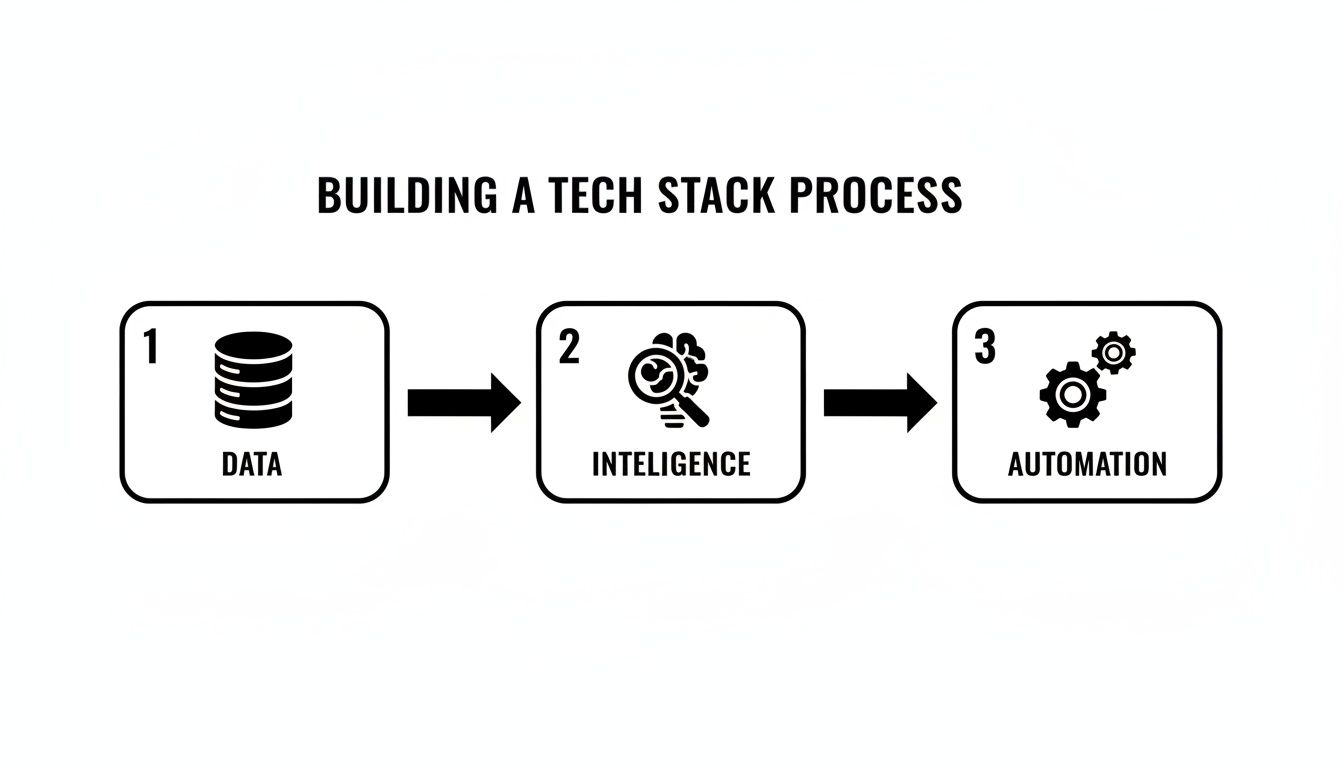

This tech stack isn't about replacing your team's intuition. It's about supercharging it. The right tools take on the grunt work—the endless data digging—freeing up your people to do what they do best: build relationships and close deals. A solid tech stack isn't just a collection of apps; it's an integrated system that smoothly moves information from discovery all the way to outreach.

Core Categories of Research Tools

Think of your toolkit in three main layers: finding the raw data, understanding what it means, and then acting on it. Each part has a specific job, and the best teams weave them together into a single, powerful source of truth.

-

Data Providers: This is your foundation. Platforms like ZoomInfo, Cognism, and Clearbit are massive libraries of firmographic and demographic info. They give you the basics—verified emails, direct-dial numbers, company size. They answer the simple but essential question: "Who is this person and how can I reach them?"

-

Sales Intelligence Platforms: These tools add the story on top of the data. Think of LinkedIn Sales Navigator or Apollo.io. They're built to help you see what’s happening in a prospect’s world—flagging buying signals, tracking job changes, showing you who reports to whom. This is how you stop guessing and start understanding who the real decision-makers are.

-

Automation Platforms: This is the glue holding everything together. An automation engine like Make connects all your other tools, creating smart workflows that run on their own. It’s the magic that takes you from looking up one contact at a time to having a system that automatically enriches, qualifies, and routes leads without a human lifting a finger.

These tools are no longer a "nice-to-have." As AI becomes more common in sales, they're becoming the price of entry. A recent report found that 54% of teams are already using AI to help write personalized outbound emails. On top of that, 45% are using it for account research—the very thing that 49% of reps say is the hardest part of their job.

Choosing the Right Tools for Your Team

With a sea of options out there, it’s easy to get overwhelmed. The trick is to tune out the noise and focus on what your team actually needs right now. A five-person startup has wildly different needs than a global enterprise with a sales team in the hundreds.

To make it easier, let's break down how each type of tool helps you solve a specific problem.

Essential Prospect Research Tool Comparison

Here’s a simple way to look at the different tool categories, what they do, and a few examples to help you start building your stack.

| Tool Category | Primary Function | Example Platforms |

|---|---|---|

| Data Providers | To acquire accurate contact and company information at scale. | ZoomInfo, Clearbit, Cognism |

| Sales Intelligence | To uncover buying signals, understand organizational context, and identify key players. | LinkedIn Sales Navigator, Apollo.io |

| Automation Platforms | To connect your tools, enrich leads automatically, and trigger workflows. | Make, Zapier |

The goal isn't just to have tools; it's to have an integrated system. A world-class data provider doesn't do you much good if its insights are trapped inside the platform. The real return comes when that data flows seamlessly into your CRM and kicks off a perfectly timed, personalized outreach sequence.

Building Your Integrated Tech Stack

The real power gets unlocked when you wire these tools together. Picture this: a new lead fills out a webinar form. Instantly, a workflow in Make springs into action.

First, it grabs the lead's email and sends it to Clearbit to pull in company data. Next, it checks their LinkedIn profile for recent posts or job changes. Finally, it creates a new task in your CRM for the assigned rep, complete with a neat summary of everything it found.

This isn't some far-off dream. It's exactly what the most efficient sales teams are doing today. By carefully choosing the best lead generation tools for B2B and hooking them together, you turn prospect research from a soul-crushing manual chore into an automated intelligence engine that fuels your entire sales process. It’s how you guarantee your team always has what they need to start better conversations and, ultimately, win more deals.

Putting AI and Automation into Practice

Theory is great, but it's time to get our hands dirty. Let’s walk through a real-world automation workflow that shows how this stuff actually works, moving beyond the concepts to something you can build yourself. This isn't just for huge companies with massive budgets; it's a practical, accessible strategy for any B2B or SaaS team.

We’ll use a classic B2B scenario to make it tangible: "How to Automatically Research and Qualify New Webinar Leads." This example will show you how to take a simple form submission and turn it into a goldmine of sales-ready intel.

The Automated Webinar Lead Workflow

Okay, picture this: someone just signed up for your next webinar. In the old days, that lead would land in a spreadsheet and sit there, gathering dust until a sales rep had a spare hour to poke around on Google and LinkedIn.

With automation, that same form submission instantly kicks off an intelligent workflow that does the heavy lifting in seconds.

Here’s the step-by-step breakdown:

-

The Trigger: It all starts the moment a new lead pops up in your webinar platform (like Zoom or GoToWebinar) or a form is filled out in your CRM (like HubSpot). This is the starting pistol for your automation.

-

Instant Data Enrichment: The workflow grabs the lead’s email and fires it off to a data provider like Clearbit or Apollo.io. Almost immediately, it gets back a payload of crucial firmographic data: company name, size, industry, annual revenue, and where they're located.

-

AI-Powered ICP Analysis: This is where the magic happens. The freshly enriched data is passed to an AI model, like OpenAI's GPT-4. The AI is given a prompt loaded with your detailed Ideal Customer Profile (ICP). It then compares the lead’s company info against your ICP criteria and answers one simple question: "Is this company a good fit for us?"

-

Automated Lead Scoring: Based on what the AI finds, the lead gets scored on the fly. For instance, if the AI flags the lead as a perfect ICP match, the workflow might assign it 25 points. If it’s only a partial match, maybe it gets 10 points.

-

Real-Time Sales Alert: If a lead’s score hits a certain threshold—meaning they're a hot prospect—the automation shoots a notification straight to a dedicated Slack channel. This alert isn't just a name and an email; it’s a complete research brief.

The Slack message that lands in front of your sales rep could look something like this:

New High-Value Webinar Lead: Acme Corp

- Contact: Jane Doe, VP of Operations

- Company Size: 500 employees, B2B SaaS

- ICP Match: 9/10 – Strong fit based on industry and size.

- Key Insight: Currently hiring for roles that use our technology.

- Next Step: Engage immediately with personalized outreach.

This entire sequence—from someone hitting 'submit' on a form to a fully researched summary appearing in Slack—happens in less than a minute. No human needed. This is exactly how you can layer data, intelligence, and automation to build a seriously effective tech stack.

As you can see, it all starts with good data. Then, you layer on intelligence to make sense of it. Finally, you use automation to scale the entire process.

Why This Automated Approach Wins

This kind of workflow completely flips the script on prospect research. It goes from a slow, manual chore to a proactive, automated system that runs 24/7. It guarantees your sales team spends their time on what they do best: talking to qualified, well-researched prospects who have already raised their hand. As you dive deeper, exploring other AI marketing tools for B2B SaaS can open up even more possibilities.

By setting up a system like this, you nail three critical business goals:

- Speed: Leads are qualified and sent to the right person in real-time. You kill the delay that so often kills deals.

- Efficiency: Your reps are free from the soul-crushing work of manual research and data entry. They can focus purely on selling.

- Intelligence: Every lead arrives with the context and insights needed to craft a personal, high-impact first message.

This hands-on example is proof that modern prospect research isn't just about finding information faster. It's about building an intelligent engine that consistently brings your best opportunities to the surface and empowers your team to act on them instantly.

Common Questions About Prospect Research

When teams start getting serious about prospect research, the same few questions always pop up. Let's tackle them head-on so you can move forward with confidence and get your whole team on the same page.

How Much Time Should a Rep Spend on Research?

The goal isn't to spend more time on research; it's to get more out of the time you do spend. A good rule of thumb is the 20/80 principle: aim to spend about 20% of your prospecting time on high-quality research. That investment makes the other 80%—the actual outreach—far more effective.

Today's automation and AI tools have completely changed this dynamic. They can slash the hours you spend manually digging for information while actually improving the quality of your insights. For most outbound messages, an automated workflow can pull 3-5 key personalization points in just a few seconds. For your top-tier enterprise accounts, you'll still want to do a deeper manual dive, but the core idea is the same: work smarter, not harder.

The point of prospect research isn’t to build a perfect, exhaustive dossier on every lead. It’s to find just enough specific, relevant information to start a real conversation that cuts through the noise.

What Is the Difference Between Lead Generation and Prospect Research?

This is a classic mix-up, but the difference is pretty simple if you think about it like fishing.

- Lead Generation is like casting a wide net. You're trying to catch as many fish as possible to fill the top of your funnel. It's a volume game.

- Prospect Research is like using a sonar to find the biggest fish, figuring out what they like to eat, and using the perfect bait. It’s the intelligence work that tells you which leads are actually worth your time and how to best approach them.

You can't have one without the other. Lead generation fills the pipeline, but prospect research makes sure you're not wasting your energy on opportunities that will never close. You either end up with an empty funnel or a funnel clogged with junk leads.

How Can I Measure the ROI of Prospect Research?

Measuring the return on your research comes down to tracking the right metrics and looking for a clear lift in performance. The easiest way to see the impact is to A/B test your campaigns—run one with in-depth research and one without. The results will speak for themselves.

Here are the key performance indicators (KPIs) that will show you a strong ROI:

- Higher Meeting Conversion Rates: You should see a clear jump in positive replies and booked meetings.

- Shorter Sales Cycles: When your conversations are relevant from the get-go, prospects move through the funnel much faster.

- Increased Average Contract Value (ACV): Good research often uncovers bigger problems, which leads to bigger opportunities and larger deals.

- Improved Lead-to-Opportunity Rate: You'll see a higher percentage of initial leads turning into qualified pipeline in your CRM.

By tracking these numbers, you can draw a straight line from your research efforts to revenue growth, proving its value to anyone in the company.

Ready to stop guessing and start building a sales pipeline you can count on? MakeAutomation specializes in creating the AI and automation frameworks that power modern prospect research. We'll help you build an intelligent system that enriches leads, finds buying signals, and gives your team what they need to close bigger deals, faster. Schedule a consultation with us today!